One of our viewers asked me about JG Wentworth reviews, so I decided to check for myself. I even talked to a couple of friends who’ve used it. They told me how they were getting small payments for years but needed cash right away. JG Wentworth helped them turn those future payments into money they could use immediately. Both said the process was simple, and it gave them the freedom to pay off bills and handle life without the stress of waiting.

Let’s take a closer look at JG Wentworth Reviews today, a business that has been causing a stir in the financial services sector. Hello friends, you may have heard their catchy song if you have ever needed debt reduction services or structured settlement purchasing. However, how do customers actually feel about their offerings? Let’s examine JG Wentworth’s many aspects. I personally reviewed it and also asked my friends about their thoughts. You can find a genuine review down below.

Is JG Wentworth Worth It? A True Review

Hey brothers and sisters! If you have ever watched daytime TV, you might have seen their ads. That “877-CASH-NOW” jingle had crossed my mind too!

But if you are stuck in debt or still need your structured settlement money, the real question is: Does JG Wentworth really help, or is it just a marketing stunt?

I write about the financial world, and I know flashy ads don’t pay the bills. You need straight talk. That’s why I’ve researched real customer experiences, terms & conditions, and industry facts to create this honest review.

First, Understand: What is JG Wentworth Worth?

When we talk about “worth it,” it’s important to first understand what it is. JG Wentworth mainly does two things:

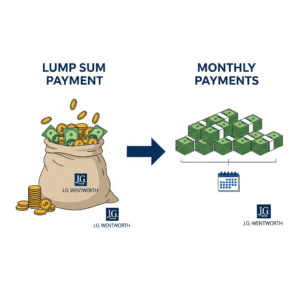

1. Structured Settlement Purchases

If you receive money from a lawsuit or lottery in monthly payments (via annuity), this company gives you a lump sum amount in exchange for future payments. You get your money right away, but at a discount.

2. Debt Relief Services

If you have unsecured debt ($10,000+) like credit cards, personal loans, or medical bills, they claim to negotiate with your creditors and reduce the amount owed. You then pay them a fee.

These are two very different services, and their reviews are also different.

The Good, the Bad, and the Useless: Real Customer Reviews

I always say—don’t judge a company by its marketing. Real feedback comes from people who have actually used it. The picture is mixed.

Good Experiences

JG Wentworth’s website is full of success stories:

- “I am so happy to be with JG Wentworth because they got me my money.” – Bianca

- “It was the best call of my life.” – Michael

- On Trustpilot, they also have 4.8 stars from 17,000+ reviews. People who had a good experience say:

- Got relief from calls from creditors.

- Debt was settled in smaller amounts.

- Got lump sum cash from annuity when needed.

- These people are genuinely happy when the process works properly.

Bad Complaints: A Pattern Appears

No company is perfect, especially in the debt business. Research on Reddit, BBB, and ConsumerAffairs shows recurring complaints:

- Credit score dropped: Debt settlement programs cause delinquency. Many were shocked at the impact.

- High sales pressure: Some felt rushed into signing without clarity.

- Poor communication: No updates for months, no clear answers.

- Court notices: Creditors still filed lawsuits despite enrollment.

- High fees: 18%-25% on successful settlements.

Final Verdict: Is JG Wentworth Right for You?

JG Wentworth is legitimate, but not right for everyone.

- Good for those with $10,000+ debt and no other way out.

- Risky if you need good credit, transparency, or lower fees.

If you have less debt, credit counseling or negotiating directly may be smarter. Always explore free options first.

Let’s Talk About the Data

Apart from reviews, here’s what the numbers show:

- ConsumerAffairs: 4.1 stars (57% gave 5 stars, many gave 1 star).

- BBB: A+ rating, but many complaints about poor communication and creditor pressure.

The Inside Truth: What Do Employees Say?

Employee reviews give another angle:

- Some praise company culture.

- Many highlight high-pressure sales and disorganized management.

Why does this matter? If employees are stressed, customer service and communication suffer.

Straight Talk: Can JG Wentworth Be Taken Seriously?

JG Wentworth is not a scam. It’s a real company. But legitimacy does not mean it’s the right choice.

JG Wentworth may work if:

- Your unsecured debt is $10,000+.

- You accept that your credit score will drop for 2–4 years.

- You are ready for creditor calls, lawsuits, and pressure.

- You are prepared to pay 18%–25% fees.

- You want quick cash from a structured settlement.

Avoid it if:

- Your debt is under $10,000.

- You need a good credit score for loans soon.

- You expect a smooth, easy process.

- You don’t want risk or fine print.

What Can You Do Best?

- Financial problems are stressful. It’s easy to grab a quick solution, but be careful.

- Smarter Alternatives:

- Try free options first: Non-profit credit counseling (like NFCC.org).

- Negotiate yourself: Call creditors directly.

- Put everything in writing: Read all agreements carefully.

Read more: Henry Meds Reviews: Is It Legit or a Scam? (Honest Customer Insights) ❤️

Questions and Answers (FAQs)

In addition to debt settlement, they turn structured settlements into lump sum payments.

A real company that has been in operation for decades, yes.

usually unsecured debt of at least $10,000.

No, but 18% to 25% is the settlement cost.

Indeed, in a big way.

Usually between two and four years.

They certainly can. JG Wentworth is unable to stop litigation.

Lump sum payment, debt reduction, and a halt to creditor calls.

litigation, poor communication, exorbitant expenses, and a low credit score.

As a last resort only. Start by looking for free or less risky choices.